Simplify Your Home Purchasing Trip With a Trusted Home Mortgage Broker

Engaging a trusted mortgage broker can simplify this trip, supplying skilled assistance and access to a range of home mortgage alternatives tailored to individual demands. Several prospective purchasers remain unclear regarding exactly how to select the appropriate broker or comprehend their function fully.

Understanding the Function of a Home Mortgage Broker

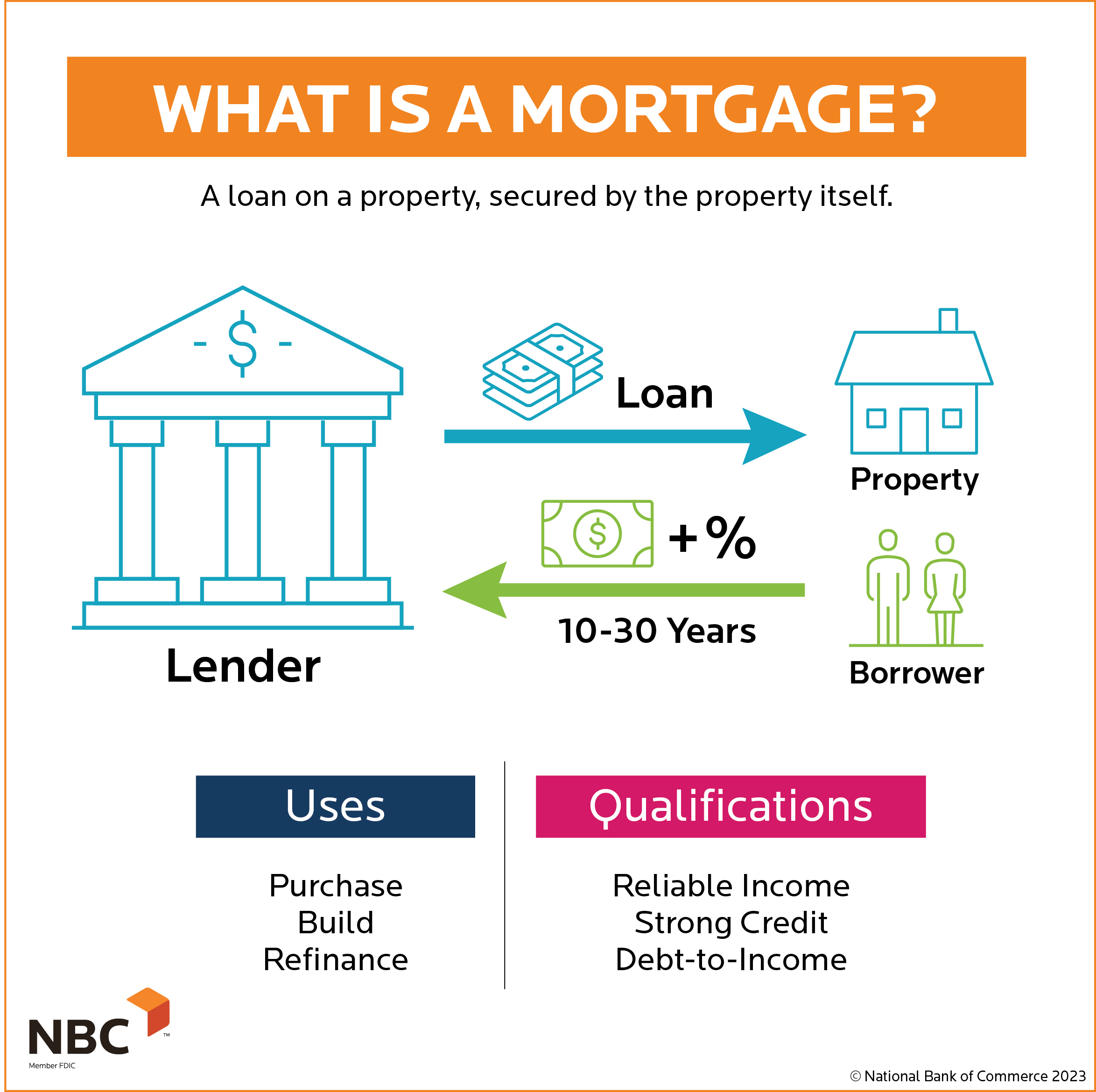

A home mortgage broker acts as an intermediary in between consumers and loan providers, helping with the home funding procedure. Their key role is to analyze the financial requirements of the debtor and connect them with appropriate car loan alternatives from different lenders. This includes celebration needed documents, such as earnings declarations and credit rating, to evaluate the debtor's qualification and monetary standing.

Along with locating suitable financing products, home loan brokers provide important market understandings (Mortgage Loans). They remain informed about present passion rates, providing standards, and arising financial products, making sure that consumers receive the most helpful terms readily available. Brokers also deal with the complex documentation connected with mortgage applications, improving the process for their customers

In addition, home mortgage brokers negotiate in support of the borrower, advocating for favorable terms and dealing with any issues that may arise during the underwriting procedure. Their expertise can help browse possible barriers, such as debt concerns or one-of-a-kind funding requirements.

Ultimately, mortgage brokers play a crucial duty in boosting the effectiveness of the home financing journey, permitting debtors to focus on finding their ideal property while ensuring that they safeguard the finest possible home mortgage choices.

Benefits of Dealing With a Broker

Collaborating with a mortgage broker uses numerous benefits that can significantly boost the home buying experience. Among the primary advantages is accessibility to a broad selection of home loan items. Brokers have relationships with different lending institutions, enabling them to existing options tailored to specific financial circumstances, which can bring about beneficial terms and reduced rates of interest.

Furthermore, home mortgage brokers possess substantial sector knowledge and experience. They can supply beneficial insights into the home loan procedure, helping clients navigate complicated terms and paperwork. This competence can conserve both effort and time, allowing homebuyers to concentrate on finding their optimal home rather of getting stuck in economic details.

Another secret advantage is individualized solution. A home mortgage broker takes the time to understand a client's distinct requirements and objectives, making sure referrals are straightened with their economic circumstances. Brokers deal with much of the communication with lending institutions, easing and streamlining the process stress and anxiety for the customer.

Last but not least, collaborating with a broker can improve negotiation power - Mortgage Loans. With their understanding of the market and lending institution assumptions, brokers can promote in support of customers to protect much better deals. On the whole, partnering with a home loan broker simplifies the course to homeownership, making it a sensible choice for many customers

Exactly How to Choose the Right Broker

Picking the best mortgage broker is critical for a smooth home getting experience. Begin by evaluating their credentials; make sure the broker is licensed and has experience in the details markets appropriate to your needs. Try to find brokers who have a tried and tested record and favorable reviews from previous clients.

Following, consider their communication design. An excellent broker must be eager and approachable to address your questions plainly. They should supply regular updates throughout the process, guaranteeing you remain comfortable and enlightened with each step.

Examine the variety of products they supply. A broker with access to several lending institutions can offer you with different loan choices customized to your financial circumstance. This adaptability can lead to much more desirable visit site terms and lower rate of interest.

The Home Mortgage Application Refine

How does one navigate the home loan application procedure effectively? The key to a smooth application hinges on prep work and recognizing the necessary steps. Begin by gathering vital documents, consisting of evidence of income, income tax return, bank statements, and identification. This info will certainly streamline the process and help your home loan broker provide a total application to loan providers.

Following, job very closely with your home loan broker to figure out the kind of home loan that finest fits your monetary situation. Your broker will assist in assessing your credit history and financial wellness, which play critical duties in establishing your eligibility and funding terms. They can likewise provide understanding right into the different mortgage products readily available, ensuring you make notified decisions.

When your application is sent, be prepared for the underwriting process. This phase entails a thorough assessment of your monetary background and property assessment. Your broker will certainly keep you educated and may request extra records to promote More hints the approval procedure.

Typical Misunderstandings About Brokers

Several homebuyers nurture misconceptions regarding the duty and value of home loan brokers in the home getting procedure. A common idea is that mortgage brokers are simply salesmen pressing specific funding items.

Another common mistaken belief is that making use of a broker incurs higher expenses. While brokers might bill costs, they frequently have accessibility to reduced rate of interest and better terms than those available directly from loan providers. This can inevitably conserve borrowers money over the life of the funding.

In addition, some customers assume that home mortgage brokers just accommodate those with poor credit report or uncommon monetary scenarios. As a matter of fact, brokers offer a varied customers, from new homebuyers to seasoned capitalists, giving helpful site valuable understandings and tailored solution no matter the customer's financial standing.

Conclusion

Engaging a relied on home loan broker significantly boosts the home purchasing experience, offering know-how and support throughout the procedure. Ultimately, leveraging the solutions of a mortgage broker can lead to a much more satisfactory and effective home acquiring journey, customized to individual monetary circumstances.

Engaging a relied on mortgage broker can enhance this trip, offering expert assistance and accessibility to a range of home loan alternatives tailored to private requirements. Mortgage Lender.A home loan broker offers as an intermediary between customers and lending institutions, promoting the home financing process. A home loan broker takes the time to recognize a customer's unique needs and goals, making sure referrals are aligned with their financial situations.Following, job very closely with your home mortgage broker to determine the type of mortgage that best fits your monetary circumstance. Eventually, leveraging the solutions of a home mortgage broker can lead to an extra acceptable and effective home acquiring journey, tailored to individual financial situations